Harnessing the Inflation Reduction Act: Case Studies in Maximizing Local Economic Benefits

July 22, 2024

By Alí R. Bustamante, Joe Peck

Introduction

Industrial policy is and has always been about targeting sector growth to achieve structural transformations in the economy (Juhász, Lane, and Rodrik 2023; Tucker 2019). The Inflation Reduction Act (IRA) aims to do just that: driving forward an economic structure that reduces carbon emissions and energy costs, strengthens national security, and creates good jobs (White House 2023a; White House 2023b).

The IRA is, at its core, a subsidy package that could total trillions of dollars in public investment aimed to crowd in many multiples more of private investment dollars in domestic energy production over a 10-year window (Inflation Reduction Act 2022; Goldman Sachs 2023). These investments are anticipated to create more than 100,000 jobs in targeted manufacturing sectors across 37 states (US Department of Energy 2024) and have the potential to drastically transform communities.

Once finalized, the IRA’s investments will provide Americans with energy production that is cleaner and cheaper than the status quo, increase the supply of renewable energy products, and reduce emissions within renewable energy product manufacturing.

“Maximizing the local economic benefits of industrial policy investments means addressing structural barriers that prevent disadvantaged workers from accessing good jobs.”

For communities to reap all the potential benefits of this tremendous job creation, they will need to organize. The IRA incentivizes (and in some cases requires) that firms receiving tax credits, loans, or grants adhere to the prevailing wage requirements under the Davis-Bacon Act that establish minimum wage rates for construction labor (US Department of Labor 2023), as well as provisions promoting the utilization of apprentices in construction labor (DOL 2024). Beyond construction, some of the IRA’s loans and grants programs give preference or priority to projects that involve collective bargaining agreements, labor peace agreements, and the inclusion of workers from disadvantaged communities. This means that only firms that utilize loans or grants under the IRA are incentivized to engage in high-road hiring practices for their manufacturing jobs, while the bulk of firms relying on the tax credit provisions alone lack any incentive. As a result, the majority of the 100,000-plus manufacturing jobs created by the IRA will lack any mechanism—guardrail or guideline—that ensures created jobs are good, union jobs.

This report analyzes five case studies to show the implications of the IRA’s weak labor standards on how local labor markets are likely to experience industrial policy investments and provides policy recommendations aimed at improving the IRA’s impact on communities.

The following sections in this report:

- Explain how the jobs created through industrial policies can benefit communities;

- Discuss how industrial investments spurred by the IRA are likely to impact the labor markets of five different communities across the country; and

- Recommend that prioritizing community engagement and democratic governance in the implementation of industrial investments can promote good jobs and deliver substantial economic benefits to local communities.

Explore the Data

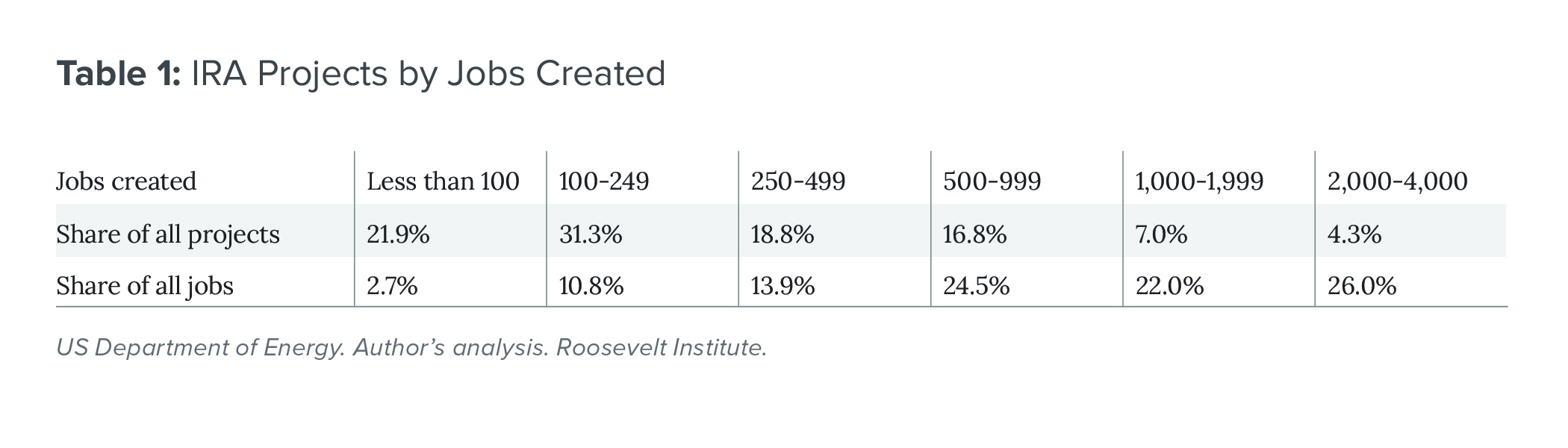

How communities engage with firms in addressing their labor needs will determine how much they benefit from incoming clean energy investments. Our analysis, based on DOE data, shows that large projects (those creating at least 500 direct jobs) account for 28.1 percent of all projects and 72.5 percent of all jobs created by post-IRA clean energy investments (see Table 1) (DOE 2024). Moderate-sized projects (100 to 499 workers) comprise half of all projects and a quarter of all jobs, while small projects represent 21.9 percent of projects and just 2.7 percent of all jobs created. The preponderance of large and moderate-sized projects means that the vast majority of post-IRA clean energy investments will have considerable impacts on local labor markets.

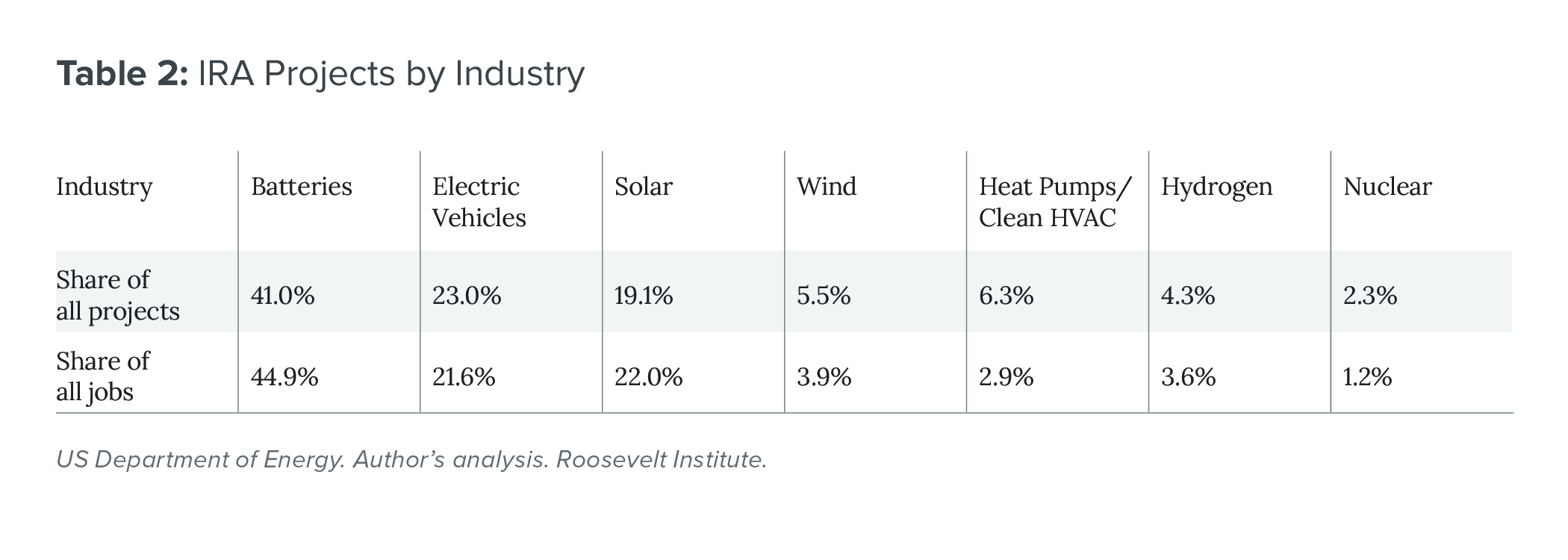

Additionally, data show that 83.3 percent of all projects and 88.3 percent of all jobs created by post-IRA clean energy investments are concentrated in the battery, electric vehicle, and solar panel manufacturing industries (see Table 2). These three industries also represent 84 percent of all large and moderate-sized projects post-IRA. Electric vehicle projects will likely be supported by the Advanced Technology Vehicle Manufacturing loan program of the IRA, which makes $3 billion available for direct loans to qualifying projects, and by the $2 billion in grants available in the Domestic Manufacturing Conversion Grants program. Battery manufacturing projects and some electric vehicle projects will largely be supported by the IRA’s Advanced Manufacturing Production Credit and Clean Electricity Investment Credit, which provide tax credits for the production of qualifying battery components and energy storage technology. Lastly, solar panel manufacturing projects will likely also benefit from the IRA’s Advanced Manufacturing Production Credit as well as the Qualifying Advanced Energy Project Credit, depending on the solar panel components produced.

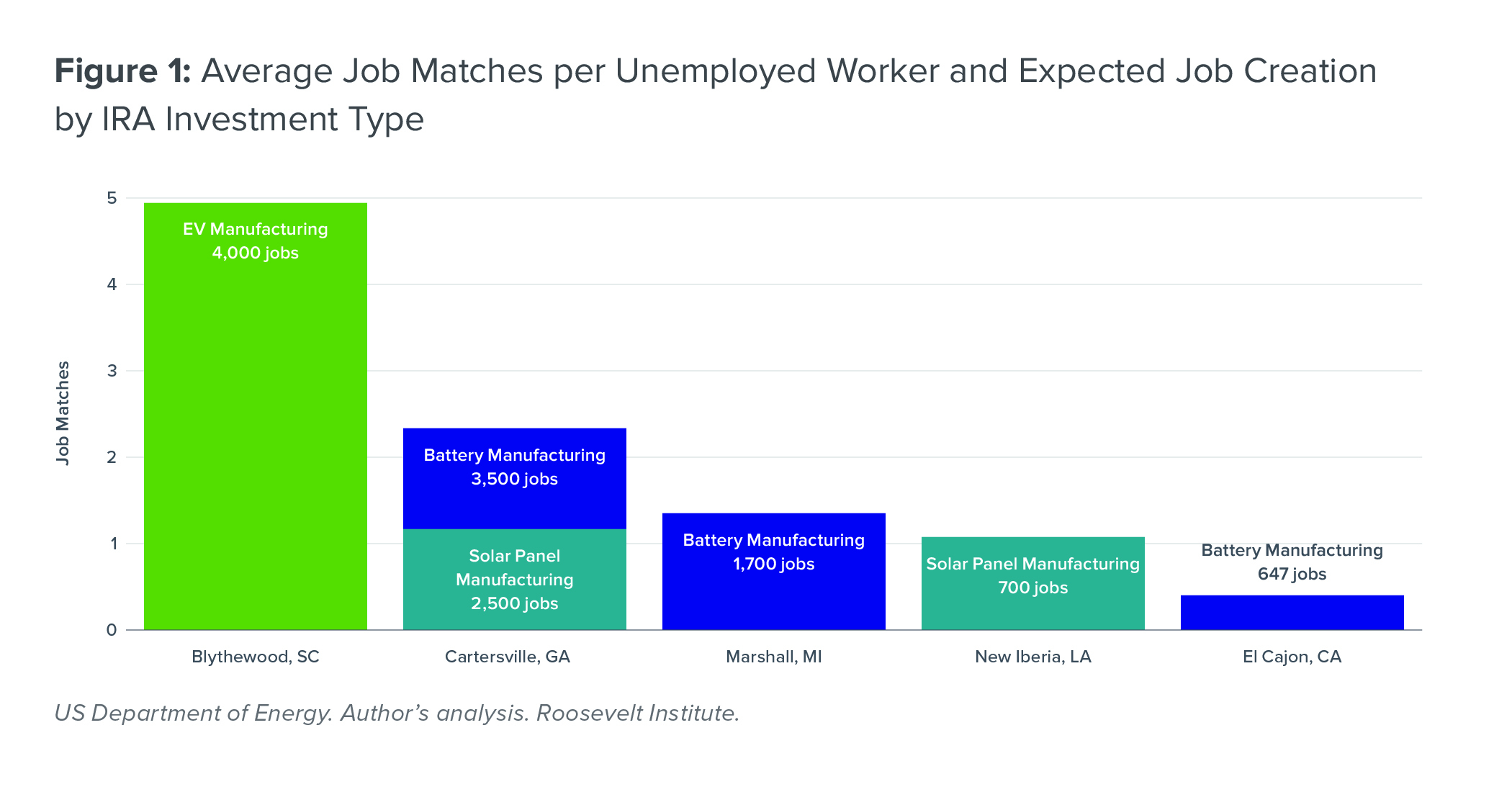

The match share, which measures how the alignment between the skills of unemployed workers and the requirements of newly created jobs leads to job matches, varies across the case studies (see Figure 1). In Blythewood, SC, and Cartersville, GA, the average job matches per unemployed worker are notably higher than in other cases, at 4.94 and 2.33 respectively—indicating better alignment and existing workforce development infrastructure. Conversely, Marshall, MI, New Iberia, LA, and El Cajon, CA, show lower job matches, ranging from 1.35 to 0.41—emphasizing the need for strategic training efforts to address skills mismatches.

Footnotes and Suggested Citation

Read the footnotes

1This discrepancy between construction and manufacturing labor is itself a result of the US Supreme Court’s gutting of the Walsh-Healey act, which had applied high-road labor standards to manufacturing firms that benefited from federal dollars. See Donahue 1964.

Suggested Citation

Bustamante, Alí R. and Joe Peck. 2024. Harnessing the Inflation Reduction Act: Case Studies in Maximizing Local Economic Benefits. New York: Roosevelt Institute.