Crypto Week: Brought to You by $TRUMP

July 16, 2025

By Bilal Baydoun

Fireside Stacks is a weekly newsletter from Roosevelt Forward about progressive politics, policy, and economics. We write on the latest with an eye toward the long game. We’re focused on building a new economy that centers economic security, shared prosperity, and rebalanced power.

The House has declared this week “Crypto Week,” seeking to pass major legislation that would embed cryptocurrencies more deeply into the US financial system. Yet the real story here is how this week is the culmination of efforts designed to specifically enrich Donald Trump personally at the expense of everyday consumers.

How did we get here?

Like so much that ails our democracy today, this latest saga began with a mountain of cash and an army of lobbyists.

The crypto industry was the single largest corporate donor of the 2024 election, pouring in over $130 million to shape the makeup of Congress and elect Trump. In Trump they found their avatar, willing to flip-flop on his early criticism of cryptocurrencies once it was clear he could enrich himself to the tune of $1 billion at last count.

To launch this grift to stratospheric levels, lawmakers are now considering three bills—all essentially written by the crypto industry—that promise to fulfill President Trump’s campaign pledge to make the US “the crypto capital of the world.”

The first is the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act that passed the Senate last month, which would provide a regulatory framework for stablecoins—digital currencies whose value is pegged to a fiat currency like the dollar (recently described in vivid terms as akin to casino chips).

The second bill, the CLARITY Act, ensures that certain crypto products are regulated by the Commodity Futures Trading Commission (CFTC) as commodities rather than securities, weakening the oversight role of the more demanding Securities and Exchange Commission (SEC) as it relates to parts of the industry.

Finally, the Central Bank Digital Currency (CBDC) Anti-Surveillance State Act ensures that a central bank–issued digital currency—which could provide some of the touted benefits of crypto without the same volatility, decentralization, and usefulness for crime—will never see the light of day.

Taken collectively, these measures would lend unprecedented legitimacy to a predatory industry and President Trump’s shadiest crypto ventures. Trump now understands crypto as an infinite source of wealth and has used it to transform the White House into a carnival of corruption.

His biggest supporters can now win prizes like paused lawsuits, presidential pardons, tariff exemptions, and political appointments, all by buying Trump-backed cryptocurrencies. These bills will ensure that the show can go on without any serious accountability and can be replicated by future officeholders across our government.

Stepping back, it’s helpful to see how deeply ingrained Trump is in the cryptocurrency world. Weeks before the 2024 election, Trump became part owner of the crypto company World Liberty Financial (WLFI), which now touts its stablecoin “USD1” as a better version of the dollar.

Anyone interested in influencing the president of the United States took notice. For instance, the Abu Dhabi–based firm MGX announced in April that it would be investing $2 billion in Binance, the world’s largest crypto exchange, and that it would use Trump’s stablecoin to close the deal.

World Liberty Financial also sells a crypto token ($WLFI) that gives holders voting rights related to certain company decisions. Last month, a mysterious entity called “Aqua 1,” based in a foreign country, bought $100 million worth of $WLFI, and Reuters estimates that the Trumps have earned half a billion dollars from WLFI since it was launched.

The identities of many of the top holders of $WLFI remain anonymous, which offers a preview of the black-market political dealing that will overtake our democracy if the crypto industry succeeds in institutionalizing itself through these bills. One of the known top holders is crypto billionaire Justin Sun, the founder of TRON Foundation, the company that oversees the blockchain platform TRON and its native cryptocurrency Tronix (TRX).

In 2023, the SEC announced civil fraud charges against Sun for allegedly violating federal securities law by “orchestrating a scheme to artificially inflate the apparent trading volume of TRX in the secondary market.”

After Sun initially purchased $30 million worth of $WLFI (the Trump-supported tokens) in December and then increased his total $WLFI holdings to $75 million in January—potentially giving the Trumps a direct eight-figure windfall, according to Bloomberg—the SEC asked a federal judge to pause the lawsuit. That pause was granted in February.

Since then, Sun has emerged as a top spender on another Trump crypto asset: the purely speculative $TRUMP memecoin. In fact, he was the winner of a sweepstakes-style contest for top $TRUMP holders and was celebrated at an exclusive White House dinner for $TRUMP investors. Just this week, Sun announced he would spend another $100 million on $TRUMP.

This story of corruption may seem abstract to the average person, given that an overwhelming majority of Americans do not use cryptocurrencies at all. And a strong majority are skeptical of their safety and reliability (despite colorful ad campaigns to convince people otherwise). Yet, these pro-crypto bills don’t offer the public strong protections when crypto scams eventually pervade our lives, as they surely will.

And the gutting of the Consumer Financial Protection Bureau ensures that victims will have no one in government to enforce consumer protection laws when they are violated.

Worse, incorporating these currencies into our financial system risks yet another financial disaster, as the elimination of the firewall between commercial and investment banking once did.

With the first crypto financial crisis on the horizon, will millions of American families once again be asked to bail out the robber barons of our oligarchic age—specifically Trump and his newfound crypto allies? And what will that do to the one resource that democracy’s survival most depends on: public trust?

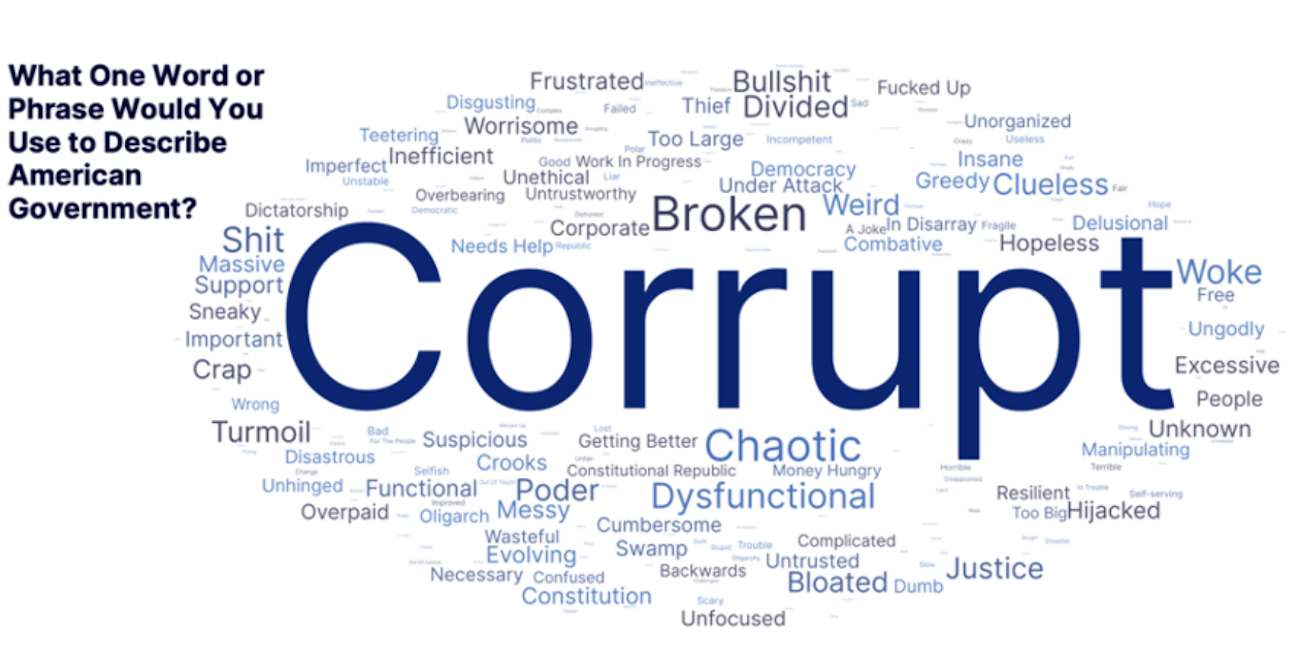

In May, the UC Berkeley Democracy Policy Lab and Ipsos surveyed attitudes related to American democracy, including attitudes about government. When participants were asked to describe American government in a single word or phrase, the most frequent response by far was “corrupt.”

In the end, the question is not whether crypto will enrich Trump or his circle (it will), but whether we are willing to accept a future in which public office is little more than a storefront for private gain. And once that trust is lost, it may prove the hardest currency of all to recover.

If you ask Eleanor

“Yet we must remember that the desire for money or power has from time immemorial corrupted men and women, and it should not be surprising if we do not seem to have made as much progress in elevating public or private morality as one might desire.”

– Eleanor Roosevelt, My Day (February 20, 1961)